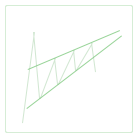

The Rising Wedge pattern resembles the Ascending Triangle: both patterns are defined by two lines drawn through peaks and bottoms, the latter headed upward. However, in case of the Rising Wedge, the upper line also moves up to the right and its slope is less than that of the lower trendline. A decent Rising Wedge has at least five reversals: three for one trendline and two for the opposite.

Both Rising and Falling Wedges show great versatility: they could appear as consolidation patterns with the trend, or against the trend, or even as topping patterns after a climax. Statistically, the latter are less often to occur but seem more striking than consolidation. When following a downtrend, the Rising Wedge pattern shows a weak rally which, in most cases, will end up breaking through the lower line, thus continuing the preceding trend. Upward breakouts are less common, but do happen every now and then and are more probable than downward breakouts in Falling Wedges. This should be especially watched out for when the Rising Wedge accompanies an uptrend: its versatile nature can make it a reversal pattern, not continuation as one might expect. Breakouts are generally expected in the second half of the pattern, closer to the middle.

Rising Wedges often come after a climax peak, a dramatic reversal of an uptrend, often on heavy volume. In this case, price within the Rising Wedge, being a rally, usually fails to reach the climax peak value and breaks through the lower line. During the pattern formation, volume is most likely to fall, which is best observed when the Rising Wedge follows the market climax.

The estimated performance of the Rising Wedge is somewhat lower than that of the falling one, with Rising Wedge that breakouts downward being one of the least reliable patterns. Wider wedges seem to be more reliable than the narrow ones.